owner's draw vs salary uk

Wages and salaries are weekly and monthly payments made from a company to the employee. If you dont actively work for the company you can receive dividends which is different from an owners drawa dividend is non-taxable.

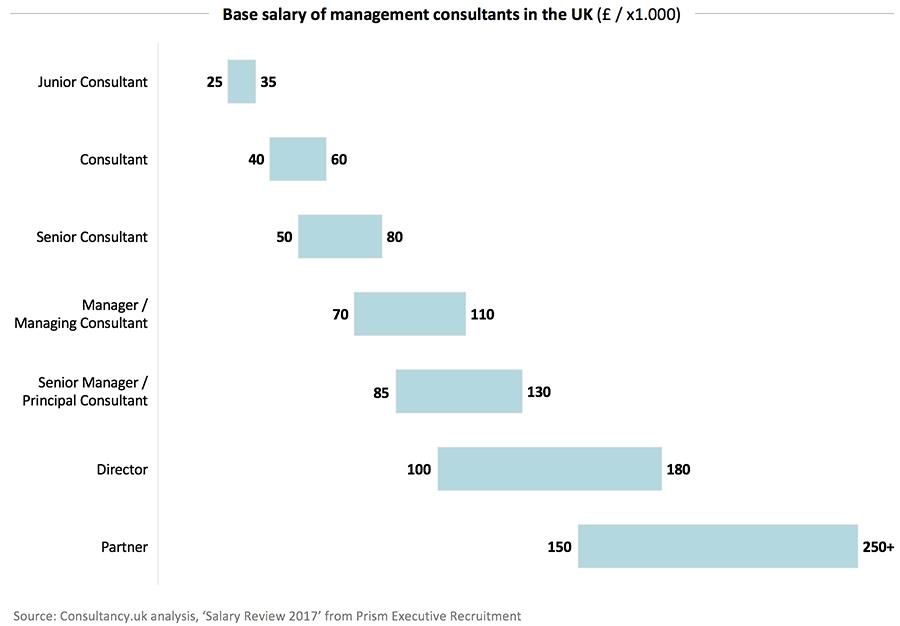

Base Salary And Total Remuneration Of Consultants In The Uk

Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how.

. If they were not actively working for the corporation then they would receive dividends as a shareholder instead. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Management is willing to pay 10 of this revenue 100000 as total annual salesperson compensation.

Clients and customers pay you you pay taxes done and done. Business owners might use a draw for compensation versus paying themselves a salary. If youre a sole proprietor business owner or a partner or an LLC being taxed like one of these taking an owners draw is the easiest.

Wages can only be paid by registered companies and employers. When should you use one over the other. 70000 contributions 30000 share of profits 15000 owners draw 85000 partner equity balance.

There are two main ways to pay yourself. Up to 32 cash back If a C-corp business owner wants to draw money above his or her salary it must be taken as a dividend payment. There are two journal entries for Owners Drawing account.

Owners draw in a C corp. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. The business owner takes funds out of the business for personal use.

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility. If you own a company of your own you can register as an employer and pay yourself a wage.

Keep in mind that a partner cant be paid a salary but a partner may be paid a guaranteed payment for services rendered to the partnership. Wages are seen as an allowable business expense and are tax-deductible. Owners draws are usually taken from your owners equity account.

There are two main ways to pay yourself as a business owner owners draw and salary. Owners Draw vs. The draw method and the salary method.

Annual base salaries range from 40000 to 60000 based upon salesperson experience and need. Salary method vs. The balance of each salespersons compensation is commission.

If a salesperson receives a base salary of 60000 their target annual. Owners Draw Taxes One of the main differences between paying yourself a salary and taking an owners draw is the tax implications. The bad news is that the dividend payment is not a tax-deductible expense.

Generally the salary option is recommended for the owners of C corps and S corps while taking an owners draw is usually a better option for LLC owners sole proprietorships and partnerships. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses.

That means that an owner can take a draw from the business up to the amount of the owners investment in the business. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. C Corporations must pay owners a salary if they are actively working for the corporation just like an employee.

Here is her partner equity balance after these transactions. Owners equity is made up of different funds including money youve invested into your business. Payroll income with taxes taken out.

As long as you keep your personal and business expenses separate ideally using separate bank accounts youre good. So to break it down again. This is because the owners.

At year-end credit the Owners Drawing account to close it for the year and transfer the balance with a debit to the Owners Equity account. If you actively work for a C corp even if youre the majority owner your only option for payment is taking a salary as a W-2 employee. A draw is a portion of the profits distributed to the owners without payroll tax withholdings.

At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. Draws can happen at regular intervals or when needed. Its a way for them to pay themselves instead of taking a salary.

If you want to take a draw from a C-corp the better option may be to take it in the form of a bonus. Likewise if youre an owner of a sole proprietorship youre considered self-employed so you wouldnt be paid a salary but instead take an owners draw. Single-member LLC owners are also considered sole proprietors for tax purposes so they would take a draw.

As we outline some of the details below. February 4 2022. Owners draws can be scheduled at regular intervals or taken only when needed.

On the other hand owners of corporations or S-corporations generally cant take a draw and would. With the draw method you can draw money from your business earning earnings as you see fit. Owners equity is made up of any funds that have been invested in the business the individuals share of any profit as well as any deductions that have been made out of the account.

Draws can happen at regular intervals or when needed. When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a distribution. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Money taken out of the business profits. Business owners can withdraw profits earned by the company.

Payroll Domain Payroll Payday App Financial

Data Report Uk Founder Salaries Share Vesting Seedlegals

9 Ways To Avoid Losing Good Employees Good Employee Latest Business News New Opportunities

Average Salary Uk A Comprehensive Overview Payspective

Average Salary Uk A Comprehensive Overview Payspective

Explore Our Sample Of Employee Payroll Change Form Template For Free Understanding Estimate Template Templates

Average Salary Uk A Comprehensive Overview Payspective

Uk Sales Survey Statistics Infographic Infographic Sales Recruitment Development

Average Salary Uk A Comprehensive Overview Payspective

Average Salary Uk A Comprehensive Overview Payspective

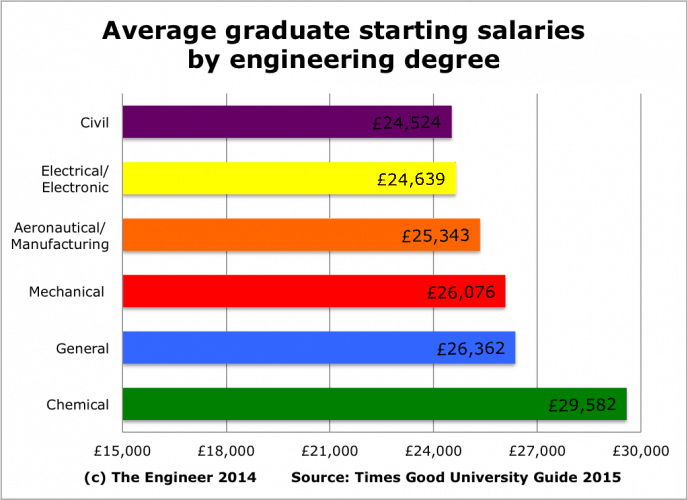

The Myth Of Engineering Low Pay

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Salary Business Owner Business

Healthcare Accountants Dentists Accountants Medical Accounting Health Care Accounting Services Hospital Doctor

Their Future Written In Pencil Hand Drawn Lettering Typography Letters Type Illustration

Average Salary Uk A Comprehensive Overview Payspective

Explore Our Example Of Pay Stub Template For Truck Driver For Free Payroll Template Statement Template Business Template

6e4187174c218b855134c4f24b6c5a4b Minimal Drawings Line Art Drawings How To Draw Hands

Ying Yang Koy Fish Yin Yang Yinyang Good Evil Chinese Balance Harmony Window Decal Laptop Decal Available In 8 Differan Yin Yang Ying Yang Yin Yang Art